If you’re anything like me, you hate hype and you despise pump-and-dump schemes.

Suffice to say, watching kids sell pixelated monkey avatars to each other isn’t exactly the sort of thing I enjoy. At first glance, this is what the much-hyped web3 is: an unregulated marketplace rife for speculation and fraud. A breeding ground for Ponzi schemes and a graveyard for many get-rich-quick dreams.

With that said, watching people I admire, such as Naval Ravikant, go all in on web3 made me think I must be missing the point. What opportunities am I missing out on by ignoring web3? And when I say “opportunities” I mean both technical (i.e. building a blockchain-based product) and financial (i.e. investing in a new asset class).

That is why I spent some time in the crypto rabbit hole last month. As a result, I have some bad news and some good news for you.

The bad news is, web3 is home to all the bad things listed a few paragraphs above.

The good news is, the underlying protocols can be used for so much more. It is not an exaggeration to say that they can revolutionize some of the biggest industries in the world.

The challenge for us, dear reader, lies in separating the hype from the substance. This article is aimed to help you see past the hype and understand the hidden possibilities.

Web3 is a haven for speculators…

The classic line that comes with most new releases of digital tokens and NFT collections goes something like this:

‘Our value proposition is to provide value to HODLers, and this thing is gonna be so big, and we’re inviting YOU to get in on the ground floor, the value could rise 10x or 100x within the next year!’

Buddy, that’s not a value proposition, that’s just a twisted way of saying ‘look, I’m in this Ponzi scheme, right…’

Anything that bases its value solely on your ability to get other people interested in it (thus increasing demand, which increases the value, which gets more people interested, and so on) is a Ponzi scheme. It’s the very definition of a Ponzi scheme.

…but web3 can be so much more than that

Imagine the same scenario as above, except now owning one of these digital assets gives you access to, say, an exclusive tech conference.

Now the value proposition grows beyond the speculative — you are buying something that has utility. Even if the dollar value of the token drops by 99%, you will still have access to that tech conference. The same applies to various educational assets, community access, and more. This is something that Gary Vaynerchuck executed perfectly with his VeeFriends project.

If you’re still not convinced, try this. What if holding the token allowed you to make a near-instant financial transaction halfway across the world with no intermediaries and no regulatory framework to worry about?

In general, tokenization allows users to own (quite literally) the internet. Take a moment to think about this concept. Social media, except nobody can censor your opinions. Banking, except there’s nobody who could decline or delay a transaction. Asset ownership certified by a protocol that nobody can cheat, forge, or take away from you.

In short, web3 can do everything web2 can do, but with users in the driving seat. If you would like to learn more about the technical possibilities, check out this wonderful podcast episode.

Web3 is unregulated (for now)…

If you had a million dollars in crypto assets and you wanted to transfer it to my wallet (I recommend this exercise) nobody would know — unless you give them your wallet address.

In the world of decentralized finance, I can trade, lend, borrow, and invest with no authorization and no identification.

…but web3 is not anonymous

You shouldn’t mistake deregulation for anonymity though.

The moment I decide to convert the million crypto dollars that you sent me into actual dollars, every government agency with any semblance of jurisdiction would be on my case.

Any platform where you can trade crypto for fiat currencies (like dollars or euros) is bound by a ton of regulations, and identifying their customers (you) using photos and national IDs is an absolute requirement.

Don’t take this lightly. If you share your wallet address with somebody who knows your identity, then they can forever observe every transaction you make. So, if you value your privacy, make sure to separate the people who know your identity (i.e. the platforms where you buy crypto for dollars) and the people who know your wallet address (i.e. people who pay you in cryptocurrencies).

Web3 is a way to diversify your portfolio…

A barbell strategy is an investing strategy where you put 90% of your assets in super-safe investments (i.e. gold) and 10% in super-risky ones (i.e. altcoins). This might be an effective way for a lot of people to diversify into crypto without gambling too much of their money.

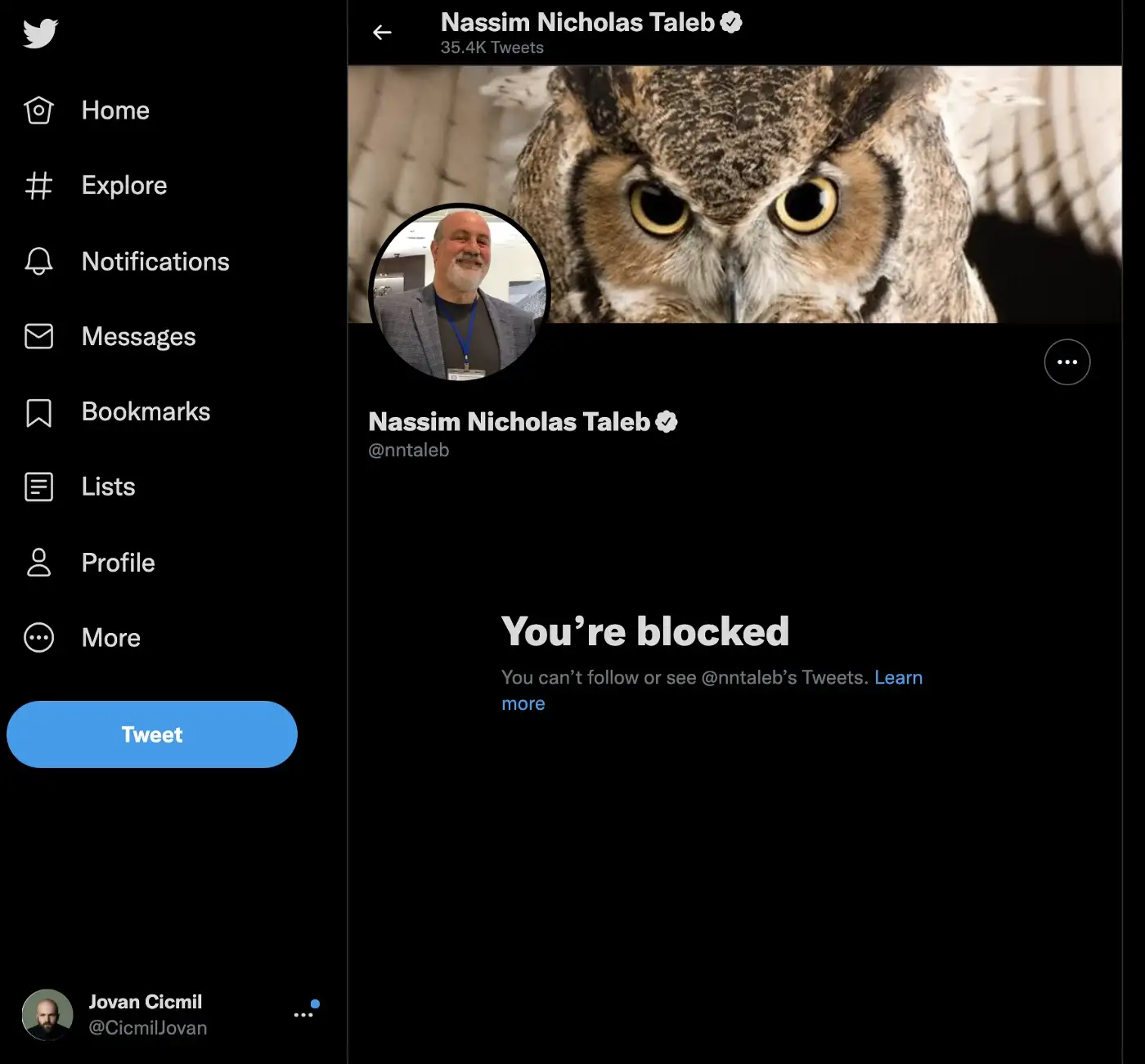

The term ‘barbell strategy’ was coined by the legendary Nassim Taleb — who, ironically, would hate this article because he is one of the foremost crypto skeptics in the world today.

So much so, in fact, that I got this treatment for questioning his views on the subject.

…but web3 is not a hedge against inflation

While I believe Taleb to be wrong when he says that all crypto is worthless, I do believe he has a point elsewhere: crypto is not the magnificent hedge against inflation that it is made out to be in certain social media circles.

For something to be a strong hedge against inflation, it should be inversely correlated with inflation. Gold is a hedge against inflation and has been proven as such historically. With crypto, there is at best second-order correlation, and at worst none at all. The volatility of this asset class makes it a highly unreliable hedge.

You want your inflation hedge to be rock-solid (gold-solid?) — it doesn’t need to be in any way related to a technological revolution or have a 1,000% upside in the next hour if Elon Musk tweets about it.

Web3 is resilient to technical errors…

The blockchain is a distributed network, meaning it runs on thousands of connected machines. There is no central server and thus no single point of failure.

The smart contracts that execute transactions on the blockchain are open-source and can be verified by anyone who desires to use them. Mistakes are thus caught early and remedied. Compare this with traditional applications where you submit sensitive data to a company and hope to God that they are handling it securely.

Furthermore, it is very costly to deploy buggy code since it can’t be easily updated, so web3 developers are a lot more careful than their web2 counterparts.

The fact that it costs to deploy a smart contract also makes for a superb defense against malevolent parties. Consider a DDOS (Distributed Denial Of Service) attack on a website, whereby a server is overwhelmed by requests. In web3, this is impossible, because executing an infinite loop of requests would bankrupt the perpetrators much sooner than it would put the network in trouble.

…but web3 is fragile to real-world events

Physical assets can be used as a fallback in catastrophic real-world scenarios, such as wars. Good luck accessing your crypto wallet when the bombs start dropping (or simply when you need to bribe an aloof government bureaucrat).

Let’s ignore catastrophes for a moment (another point Taleb would hate — ignore the possibility of black swans at your peril). Crypto assets are also susceptible to regulatory attacks from governments, pressure from lobbying groups, and all manners of political machinations.

For instance, what happens if your government decides to straight-up ban buying cryptocurrencies? I can hear you saying “joke’s on them, I already have a bunch of crypto assets”. But the joke is not on them — if people can’t exchange fiat currency for crypto, the liquidity train stops right there, and if you don’t know what happens when markets lose liquidity, you probably shouldn’t be trading anything in the first place.

With that said, I don’t think it is likely that the governments of the world will make a concerted effort to take out the crypto market. There is far too much money to be made by taxing and regulating it.

Conclusion

When talking about early-stage technologies, it is important to look past the current implementations and think about potential future applications. As Chris Dixon once said: what smart people do on weekends today, everybody will be doing on weekdays in ten years.

Blockchain technology can be used for a lot of great things and it might someday permeate every aspect of life. Some local governments are catching on and the possibilities of crypto cities are being explored around the world. There are many promising examples of how tokenization can be integrated into existing real-world processes (such as voting and taxes) to make them more efficient and reliable.

As the possibilities unfold before our eyes, it is up to us to separate the hype from the substance — and separate the wonderful world of innovation that’s begging to be discovered from the kid in your Twitter inbox trying to sell you the next to the moon coin (that he just created last night).

I hope that this article helps you see some of the possibilities of a decentralized web and, perhaps, even inspire you to create something in this space yourself.

Don't miss the next blog post!

I publish a new blog post every Wednesday. Join the newsletter to get:

- One valuable email a week.

- Zero spam.

- Exclusive content not found in the blog.

- Reply directly to me with questions or feedback.

Use the form at the bottom of this pageon the right to join the newsletter.