Tired of stories about how people got crazy returns from a single brilliant move? They’re everywhere these days. There were probably a couple on the page where you clicked on this article.

Not to worry — I’ve got you covered. Here’s an (arguably more instructive) story about how I cheated myself out of thousands of dollars with a single wiseguy move.

On being far-sighted…

In mid-2021, I had a major freelance client. I had been working for them for over a year at that point. They paid me weekly, in US dollars. I’m based in Europe but dollars suited me fine since I invest mainly in the US stock market.

However, at that point, I realized I’d have some large upcoming expenses in Euros, so I thought I’d ask the client to pay me in Euros directly.

Why should I lose 2–3% of my money on conversion rate differences if I’m gonna need cash in Euros anyway?

— me, being “far-sighted”

I was also watching the dollar’s inflation and thinking I might be better off with Euros. Or maybe this is a post-hoc rationalization that I adopted. We will never know for sure.

On timing…

I explained the situation to the client and he happily obliged. We converted the weekly dollar amount to euros and, from that point onward, my weekly salary was fixed in euros.

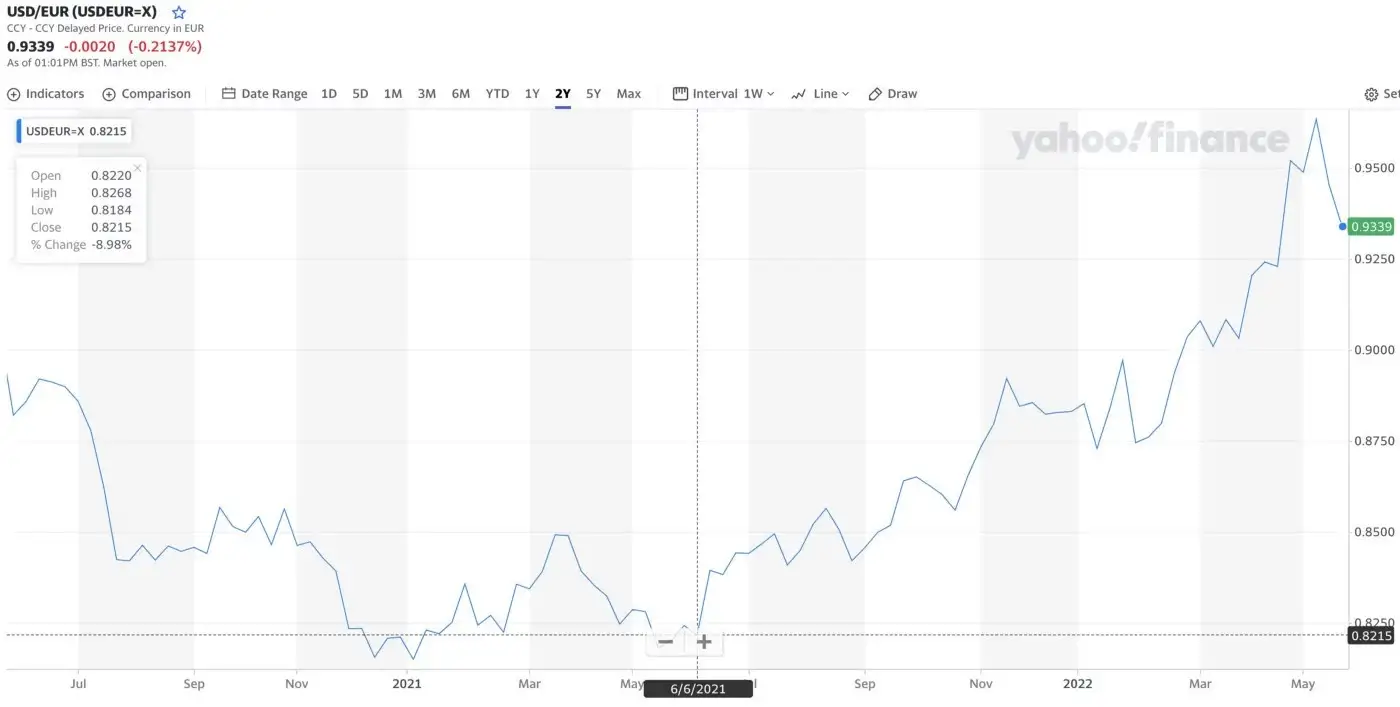

What point is that, you might wonder. This is the point:

If you can read a chart, you are now probably making the face that people generally make when they stub their toe.

On maths…

I’m still receiving the salary from this client in euros. To help you understand the magnitude of my mistake, let’s do some math.

I’ll shy away from using real numbers, but I can illustrate with some nice, round, fictional values.

If I was earning $10,000 before my moment of far-sightedness, the new salary after the currency switch would be €8,100.

Today, the €8,100 I’m making is worth around $8,600. In other words, if I was still earning $10,000, I could convert that to about €9,300.

I effectively lowered my salary by about 14% by trying to save a bit on conversion rates and betting against the dollar.

On learning from my mistakes…

What can we learn from this?

First of all, the currency market makes no sense. Never has, never will. Play at your own risk.

Never put yourself in a position where your livelihood depends on market movements. In this case, my earnings took a hit, but it doesn’t have a huge effect on my life. People sometimes take on debt along with exposure to exchange rates. If that combination goes south, you’re gonna have a bad time. For example, taking on a mortgage in euros that you have to pay back in Swiss francs. Banks actually sold this deal to a bunch of people in my country some years ago. They had a bad time.

Second, receiving payments in the same currency you have most of your expenses makes sense on the whole.

It turned out bad this time but, at that moment, the decision made sense. If I had done the reverse (switched from euros to dollars) and that ended badly, I would beat myself up about it a lot more.

Third, diversification softens the blow. Having some of my other (albeit smaller) income streams in dollars made the situation better overall.

Fourth, income above all else. When your income is strong, you can absorb hits from the occasional poor decision (or poor outcome of a good decision if you insist on blaming “the market” and not yourself).

You can be just like me!

When you play games, you have to lose occasionally.

If you can afford to lose, a loss is a foundation for future victories. Just make sure to stay out of games where you can’t recover from a loss.

People have trouble letting go of losses. I’m not one of them. Losses are inevitable. What matters is that you learn from them and come out ahead in the long run. Choose your games wisely, play them as best you can, and if you lose take it on the chin. Bonus points for sharing the lessons of your losses with the world to help others avoid making the same mistakes.

Don't miss the next blog post!

I publish a new blog post every Wednesday. Join the newsletter to get:

- One valuable email a week.

- Zero spam.

- Exclusive content not found in the blog.

- Reply directly to me with questions or feedback.

Use the form at the bottom of this pageon the right to join the newsletter.